Starting 2023 Signature Title experienced an attempted scam with a fraudulent buyer. Having an awareness of potential red flags our team was able to recognize warning signs and ultimately stop the transaction before it went any further. Fraudulent Sellers and Buyers are on the rise and awareness is key to keep your client safe.

In this article:

- Can You Spot a Real Estate Email Scam?

- How Do Real Estate Scams Work?

- Who Are the Main Targets of Real Estate Scams

- How To Quickly Spot a Real Estate Scam: 7 Warning Signs

- The 11 Latest and Most Common Real Estate Scams

- Were You the Victim of a Real Estate Scam? Do This!

- The Bottom Line: Protect Yourself from Real Estate Scams

Can You Spot a Real Estate Email Scam?

Two days after the Doe Family wired over $900,000 for the down payment and closing costs on their dream home, their mortgage company called to ask where the money was. Confused and panicked, the Doe’s checked their email — and discovered that a scammer had hacked into their conversation and switched the payment information so that the money would go straight to the scammer. The money, and their home, were gone.

According to the FBI’s Internet Crime Complaint Center (IC3) Americans lost over $350 million to real estate fraud scams last year alone.

Buying a home is likely one of the biggest purchases you’ll make in your lifetime. Unfortunately, this makes real estate a prime target for fraudsters.

If you’re buying (or selling) a home, you need to be extra vigilant when it comes to scams. Here is a breakdown on how real estate scams work, the red flags to watch out for, and how to avoid the latest real estate scams — so that you can keep your home and money safe.

How Do Real Estate Scams Work?

Real estate scammers use numerous types of methods to steal your money, personal information, or even your home title.

Because the home buying process is complicated (and not something that most people go through more than a few times in their life), fraudsters have ample opportunities to scam you.

Here’s how a typical real estate scam plays out:

- Scammers impersonate a lender, real estate agent, or title company. They may create fake listings, target you with phishing emails and texts, or offer too-good-to-be-true mortgage rates.

- Next, they communicate with a home buyer or homeowner — usually via emails, text messages, or phone calls (which make scams easier to pull off than in-person meetings). They use high-pressure sales tactics to create a sense of urgency, encouraging the victim to act without thinking.

- Next, the scammers convince the victim to send money, usually through a wire transfer or payment app such as Venmo, CashApp, or Zelle. Or, they may convince you to give them personal information that they can use to steal your identity or home title.

- Once they get paid, the scammers disappear.

Who Are the Main Targets of Real Estate Scams?

Anyone buying or selling a home can get scammed. However, real estate scams typically fall under a few categories:

- Real estate scams targeting home buyers. Fraudsters intercept wire transfers meant for down payments, create fraudulent or misleading listings, and trick would-be homeowners into paying deposits on “invisible” listings.

- Investment schemes. Scammers may try to lure people into investing in fake real estate developments or other fraudulent investment opportunities. They promise high returns with little risk, but the investments are often fake.

- Title fraud. Scammers may try to steal the title to a property by forging documents or using other fraudulent methods. They may then sell the property to an unsuspecting buyer.

- Mortgages and other scams targeting current homeowners. From mortgage wire fraud to reverse mortgages, these schemes are designed to trick homeowners into giving big payments to scammers.

How To Quickly Spot a Real Estate Scam: 7 Warning Signs

Real estate scams rely on similar social engineering tactics to rental scams — including creating a sense of urgency, dangling an unbelievable deal, or making you feel like you’ll “miss out” if you don’t act quickly.

However, since homebuyers are sending bigger payments, they are prime targets for spear phishing and other targeted scams.

Fortunately, there are some common red flags that can indicate a real estate scam:

- Pressure to act quickly. Scammers try to pressure you into making a decision quickly without giving you time to do your own research.

- Offers that seem too good to be true. Be wary of deals that seem too good to be true, such as properties being offered at prices significantly below market value.

- Requests for money upfront. Scammers ask for money upfront to cover fees or taxes, or to secure a loan or investment opportunity.

- Poor grammar or spelling in emails and texts. Small details like this can indicate that the “deal” isn’t professional, or the scammer is located in another country (and is not fluent in English).

- Asking for payment via CashApp, Venmo, Zelle, Western Union, or other suspicious payment methods. Scammers love these platforms because payments are treated like cash and can’t be easily reversed.

- The details don’t add up. Trust your gut. If someone is overly vague or contradicts themselves, this is a major red flag.

- Offering an all-cash payment or more money than you are asking for. Unless you are involved in a bidding war, this is the sign of a classic overpayment scam.

The 11 Latest and Most Common Real Estate Scams

- Real estate wire fraud (stolen down payments and closing costs)

- Mortgage wire fraud

- Bait-and-switch home listings

- Hidden property damage (and shady property inspectors)

- “We Buy Homes for Cash” scams

- Real estate investment scam seminars

- Text messages from fake buyers looking to purchase a home in your area

- Foreclosure relief fraud and other refinancing scams

- Reverse mortgage scams

- Deed fraud

- Scam homebuyers suing for discounts (i.e., lockout clauses)

Real estate scams have cost victims hundreds of thousands of dollars — with little recourse to get their stolen money back. Here are the latest scams you need to watch out for:

1. Real estate wire fraud (stolen down payments and closing costs)

Real estate wire fraud occurs when scammers intercept or steal a potential homebuyer’s down payment or closing costs. This scam is increasing nationwide, especially in high-end markets.

Fraudsters use what’s known as Business Email Compromise (BEC) to insert themselves into email conversations between buyers and lawyers or mortgage companies. Then, they send over false wire transfer information that reroutes the buyer’s payment directly to them.

In one example, Jane Doe lost $42,000 when scammers impersonated her real estate agent’s paralegal. After the fraud was discovered, Jenna realized the scammer was using an email address similar to the paralegal’s — but with two extra letters in it.

How to tell if it’s a scam (and what to do):

- Always check the sender’s email address to ensure it’s not a spoof account. Look for additional letters, numbers, spelling mistakes, or any inconsistencies.

- Use a cashier’s check — or better yet, an escrow service — when wiring funds.

- Beware of fraudulent cashiers checks for earnest money deposits. Scammers try to make a purchase sending a fraudulent cashiers check then they contact escrow a week later stating that they want to cancel and request a refund of their deposit.

- Before sending money, call your real estate agent first if you receive an email claiming there needs to be a change to your transfer to “verify” that the information is legitimate. Scammers often use pressure tactics to get people to react before thinking about the situation.

- Verify all wiring instructions before sending a large payment. Stay on the call during the wire transfer process.

2. Mortgage wire fraud

Mortgage wire fraud is similar to real estate wire fraud, except that scammers target victims’ mortgage payments.

In these scams, fraudsters collect as much information as possible about borrowers, including the home they’re buying and their financing deal. Then, they impersonate a contact person at the lender’s office and state that there’s a change in the wire details on the buyer’s mortgage payments.

How to tell if it’s a scam (and what to do):

- Don’t reply to emails stating there needs to be a change to the wire transfer instructions. Instead, call your direct contact to make sure they actually sent the information.

3. Bait-and-switch home listings

Bait-and-switch scams occur when a potential home buyer calls a realtor or real estate agent to ask about an advertised home that they saw for sale (on a site like Zillow, Craigslist, or social media platform) that seems “too good to be true.”

First, the agent informs the caller that it’s no longer for sale. Then, the agent offers to show other listings that are more expensive or of lower quality.

Bait-and-switch practices violate the FTC Act since they’re unfair and deceptive. Unfortunately, it’s often difficult to prove that bait-and-switch tactics were used.

Additionally, sometimes legitimate agents may have an inactive listing posted on their profile page. But in this case, the agent will offer to show comparable units at a similar price, size, and quality — not something priced too high or of lower quality.

How to tell if it’s a scam (and what to do):

- Research “too good to be true” new home listings carefully and compare the listing you’re interested into comparable listings in the area.

- If you feel agents are using bait-and-switch tactics, stop working with them and don’t give them any of your personal information.

- Do your due diligence and research any real estate professionals before deciding to work with them for the first time.

4. Hidden property damage (and shady property inspectors)

Buyers can become victims of home inspection scams. For example, home inspectors may either intentionally perform a poor inspection or lack the necessary knowledge and skills needed to perform the inspection.

Regardless, the result is a report that misses damages or problems (or intentionally leaves the information out). Unfortunately, the buyer ends up with a home that needs unexpected repairs.

How to tell if it’s a scam (and what to do):

- Research home inspectors carefully. Read reviews and get trusted recommendations. Only hire inspectors that are certified (if offered in your area).

- Get in writing exactly what an inspector will do during the home inspection. Ask if they have errors and omissions (E&O) insurance.

5. “We Buy Homes for Cash” scams

Homeowners who are facing foreclosure, can’t afford home repairs, or need to sell quickly “as is” may be tempted by “We Buy Homes for Cash” offers.

There are legitimate companies that buy properties for quick cash payments — however there are also scam artists who use this as a front for their frauds.

Scammers lure sellers in with offers to buy their homes for cash “as is.” But then, they either try to get the seller to sign the deed over before the scammers actually pay for the house or charge the homeowner “hidden fees” after the contract is signed (or before — with no intention of buying the house).

How to tell if it’s a scam (and what to do):

- Research any cash purchase companies to ensure that they’re legitimate. You can use the Better Business Bureau (BBB) to check for past ratings or complaints. Additionally, search the businesses name + “scam / fraud / reviews” to see what past customers have said.

- Don’t proceed if the person or company is pressuring you to act quickly, is rushing you to sign a contract, or wants you to sign over the deed before the closing (or before receiving money).

- Don’t pay any fees before the closing and ask for proof of funds to be sure that the sale is good. If the buyer refuses, it is likely a scam.

6. Real estate investment scam seminars

These scammers sell training programs and services to people who want to buy rental properties and become real estate investors. The programs often make big promises about teaching a formula with “proven” results and getting rich fast.

But after buying the expensive workshops, attendees don’t receive the necessary information. Instead, the seminar contains additional sales pitches for more “advanced training” at an even higher price.

How to tell if it’s a scam (and what to do):

- Be wary of seminars that make unrealistic promises. If anyone claims that you’ll make a ton of money with no experience, or that an investment is a “sure thing,” it’s a scam.

- Research seminars thoroughly, including checking online reviews. Ask questions like whether the seminar is for the actual program or if there will be an upsell.

- Talk to local real estate agents or investors about their opinions of the seminar or speaker.

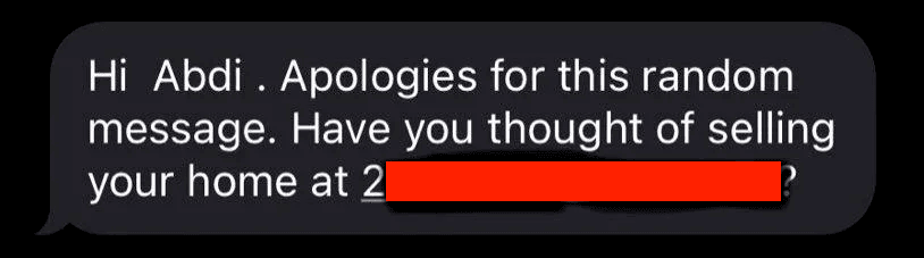

7. Text messages from fake buyers looking to purchase a home in your area

Many people nationwide report receiving unsolicited text messages asking if they want to sell their homes. But these are just scams designed to gather more personal information from you and steal your identity.

How to tell if it’s a scam (and what to do):

- Don’t reply to any unsolicited texts about buying your home. Legitimate buyers will work with real estate agents and approach you with a valid offer.

- If you receive these messages, block the phone number to avoid future texts, use spam-blocking technology, and add your name and phone number to the National Do Not Call Registry.

8. Foreclosure relief fraud and other refinancing scams

Scammers contact people struggling to pay their mortgages and promise to either modify their loans for an upfront fee or stop a foreclosure. But these are empty promises, and victims end up paying upfront fees for useless services.

In a worst-case scenario, fraudsters pose as “leaseback companies” and convince victims to sign their deeds over to them. But the “rent” turns out to be more expensive than a mortgage — and victims end up losing their homes.

How to tell if it’s a scam (and what to do):

- Be wary of loan modification programs or foreclosure counselors that require upfront fees before providing services — these are likely scammers.

- Avoid people that pressure you to pay them or use scare tactics. They are likely scammers.

- Don’t work with anyone who tells you to send your mortgage payments directly to them, asks you not to contact your mortgage company, or wants you to sign your deed over to them.

- Don’t declare bankruptcy as a way to “delay” foreclosure. If you need assistance, contact your lender or a government agency like the U.S. Department of Housing and Urban Development (HUD).

9. Reverse mortgage scams

Reverse mortgages are loans designed for property owners who are ages 62 and up. They can borrow against their home’s equity and not have to repay it until they move or pass away.

Legitimate reverse mortgages are available under the Federal Housing Administration’s Home Equity Conversion Mortgage program. However, scam artists often target seniors with fake reverse mortgage scams that con homeowners out of money, equity, and sometimes their homes.

How to tell if it’s a scam (and what to do):

- Research the reverse mortgage lender to confirm its legitimacy — Check their Better Business Bureau (BBB) standing, and read client reviews.

- Don’t sign any documents that you don’t fully understand. Never work with anyone who uses pressure or scare tactics to get you to sign a contract.

- Make sure the lender is providing loans backed by the federal government. If you’re unsure, talk to a trusted expert, like a financial advisor or a HUD-certified housing counselor.

10. Deed fraud

In extreme cases, fraudsters can even steal your home title.

One form of deed fraud occurs when scammers steal a homeowner’s personal information and use it to transfer the home’s title to their name. The thief may then try to sell or rent the home or obtain a home equity line of credit without the original owner’s knowledge.

Another form impacts a potential home buyer. A buyer purchases or rents a home believing they’re dealing with the true owner. But the scammer is using a fake title. The buyer gives the scammer a deposit or earnest money — believing they have a place to live when they don’t.

How to tell if it’s a scam (and what to do):

- Check information regarding properties that you own through your county’s deeds office. Investigate any paperwork that looks suspicious or unfamiliar.

- Review any information you receive from a mortgage company, especially if it’s a company you don’t recognize.

- Consider signing up for identity theft protection that monitors your home title.

11. Scam homebuyers suing for discounts (i.e., lockout clauses)

This scam targets “for sale by owner” (FSBO) sellers who may not fully understand real estate contracts and jargon. (A downside of not having representation from a licensed realtor)

The buyer, who is the con artist, insists that a lockout clause be included in the contract. This prevents the seller from selling the house to anyone else.

During this time, the buyer insists that the seller pay for various processing fees and other costs. The buyer may claim that they’ll pay the funds back at closing — but has no intention of actually buying the home.

As a result, the seller is out the money that they spent, and can’t sell the home during the lockout period.

How to tell if it’s a scam (and what to do):

- Don’t sign any documents or contracts without first fully understanding all of the language. For example, while lockout clauses can have good uses, these clauses should contain a short, clearly defined period of time.

- Be wary of a buyer who is applying pressure or aggressive tactics.

Were You the Victim of a Real Estate Scam? Do This!

- Tell someone you trust. Many people are embarrassed that they got scammed. However, fraudsters rely on victims keeping quiet to continue their scams without getting caught.

- Cancel any loans. If the real estate scammer had you take out a loan or do a reverse mortgage, reach out to the lender within three days. This is typically within a contract’s “cooling-off period.”

- Freeze your credit with the three major credit bureaus — TransUnion, Equifax, and Experian. When you freeze your credit, scammers can’t open a bank account or get a credit card in your name. You can lock your Experian credit file with just one tap by using Aura’s easy-to-use mobile or desktop app.

- File a chargeback for any payments that you made to the scammer. If you made payments to the scammer, contact your bank or credit card company to report the charge right away. You may be able to reverse a wire transfer or get the charge removed from your credit card account.

- Save any communication you had with the scammer. This information may not only help you get your money back but can also be used to prosecute the scammer.

- File reports with the Federal Trade Commission (FTC), the FBI’s Internet Crime Complaint Center (IC3), and local law enforcement. You can report a crime at IdentityTheft.Gov as well as file a police report with local law enforcement agencies.

- Pay close attention to your credit report for any signs of fraud or identity theft.

The Bottom Line: Protect Yourself from Real Estate Scams

When it comes to buying and selling real estate, it pays to do your due diligence and not jump into anything too quickly. Scammers take advantage of the complicated and lucrative homebuying process to try and scam you or anyone involved in the transaction out of hard-earned money.

Be vigilant in looking for the warning signs and reach out to trusted professionals in the industry with any doubts or questions you may have.